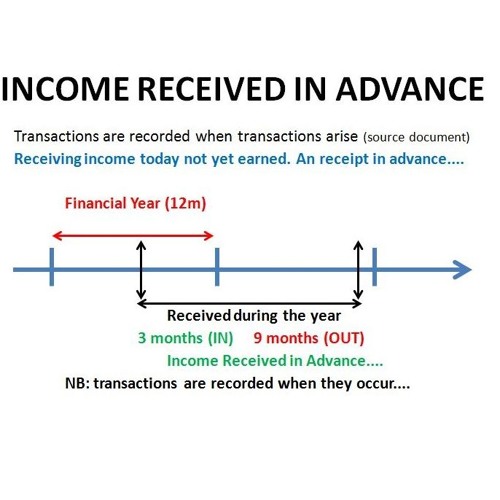

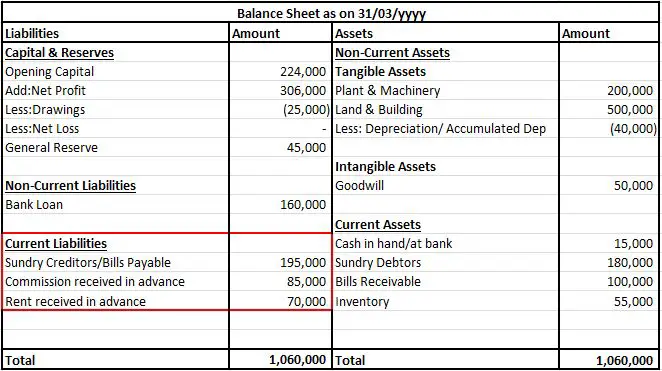

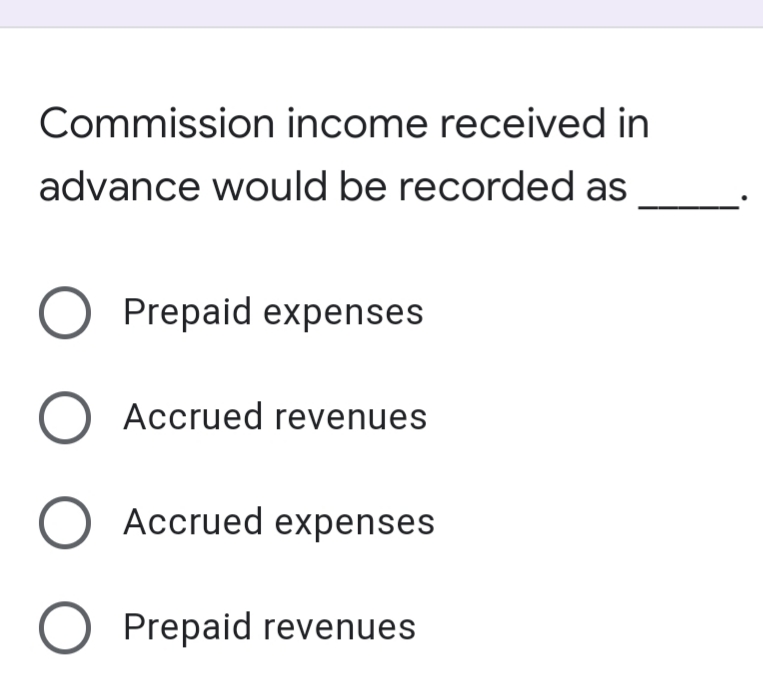

Consider the following adjusting entries:1. Outstanding expenses : Expense A/c Dr To Outstanding Expenses A/c2. Prepaid expenses : Expenses A/c Dr To Prepaid Expenses A/c3. Income earned and not received : Income

Stream episode Income Received In Advance Definition (adjustment) by Creativo Solutions podcast | Listen online for free on SoundCloud

What is Income Received in Advance - Income Received in Advance Sometimes earned revenue that - Studocu

:max_bytes(150000):strip_icc()/UnearnedRevenue_Final_4187402-aa562f3cdfef4c4ebb22c69bdb055237.png)

:max_bytes(150000):strip_icc()/IncomeV2-edit-5e17793a21054438b9a6612e489d4904.jpg)