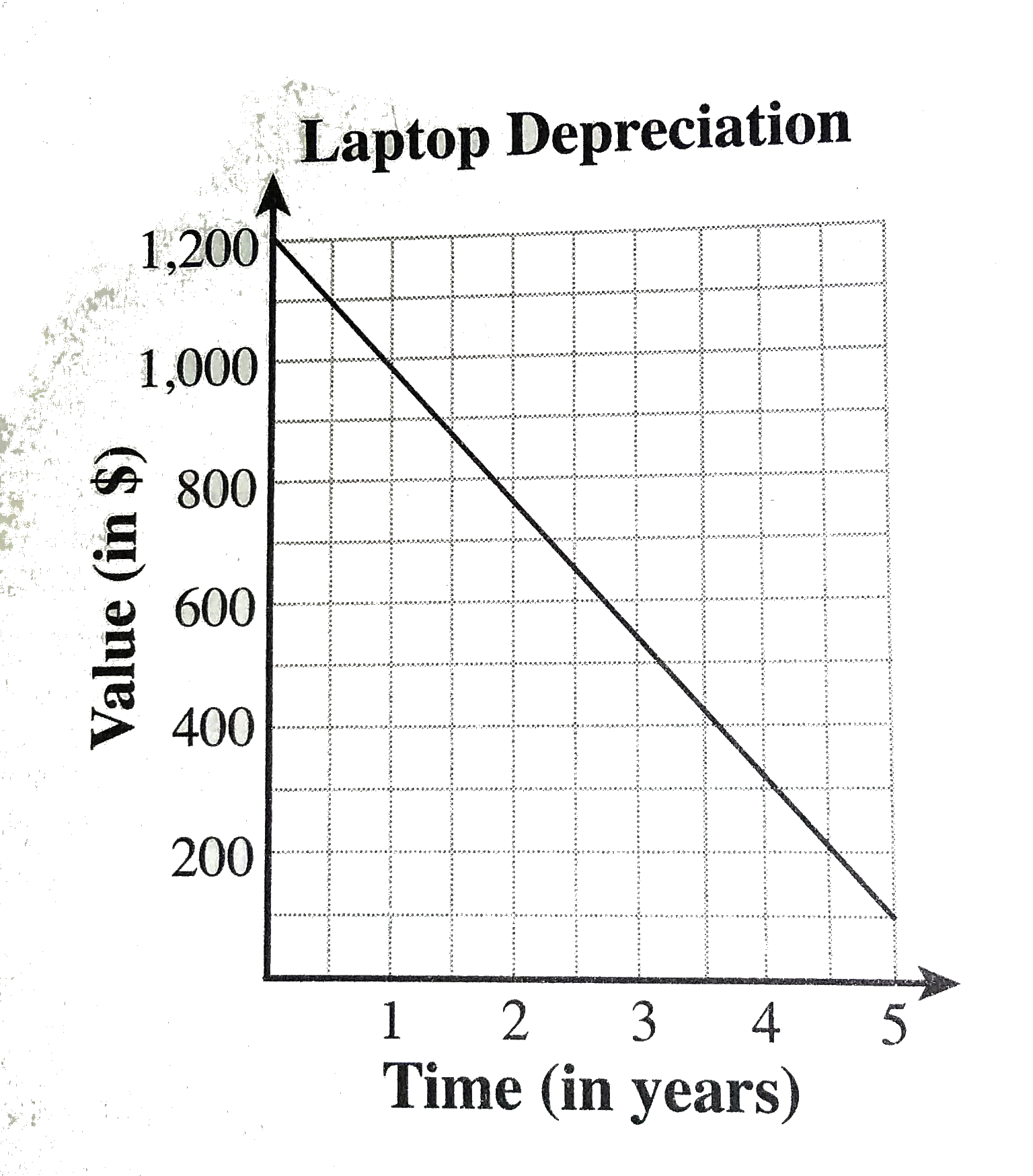

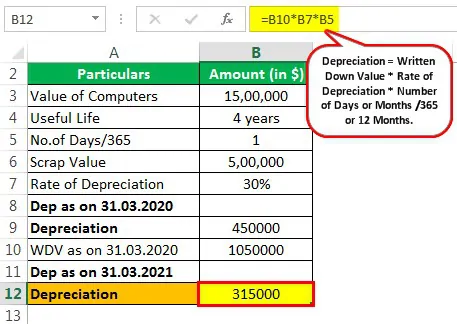

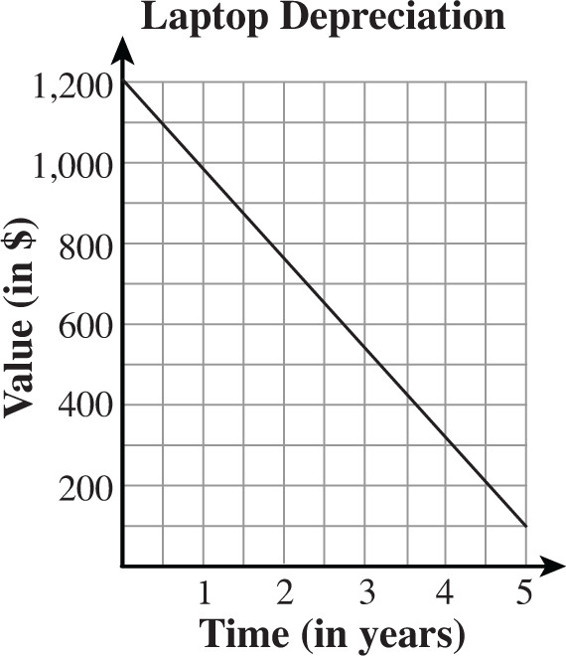

The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -

Double Declining Balance (Method of Depreciation) | Double Declining Balance | By IGCSE Accounting Private | Hey there Welcome back to accounting stuff I'm James and in this video, I'll show you